All Categories

Featured

Table of Contents

[/video]

If you intend to become your own financial institution, you've come to the ideal area. But first, do you know just how banks handle to be the richest establishments worldwide? Let's claim you transfer $10,000 in the financial savings account. Do you assume the financial institution is going to rest on that cash? The bank is going to take your down payment and lend it bent on an individual that needs a new auto or house.

Did you know that financial institutions gain in between 500% and 1800% more than you? If the financial institutions can basically relocate money and make rate of interest that method, would not you such as to do the exact same?

Nelson Nash was battling with high rate of interest rates on business financial institution loans, however he effectively did away with them and began instructing others how to do the same. Among our favored quotes from him is: "The extremely initial principle that should be understood is that you finance whatever you buyyou either pay passion to somebody else or you offer up the interest you can have made or else." Before we describe this process, we intend to ensure you comprehend that this is not a sprint; it's a marathon.

Infinite Banking With Iul: A Step-by-step Guide ...

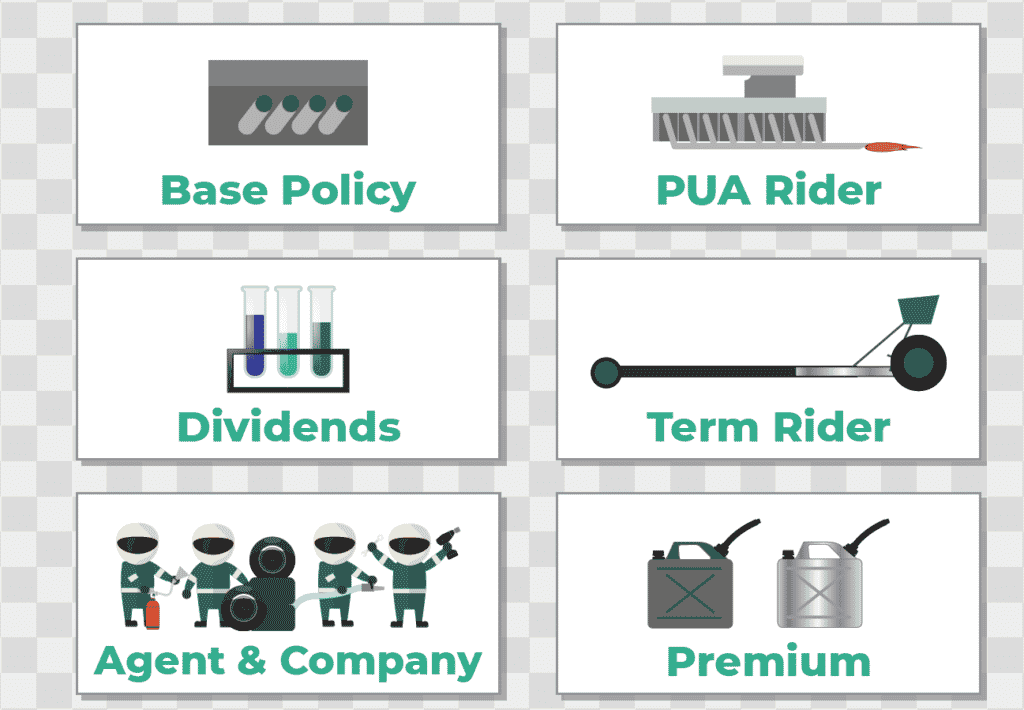

A whole life insurance coverage plan is a kind of permanent life insurance coverage, as it gives life protection as long as you pay the premiums. An additional difference between term insurance and entire life is the cash worth.

As we saw, in the conventional financial system, you have a financial savings account where you deposit your cash, which will certainly make interest. But the trouble is, we don't get wealthierthe banks do. Given that we want to duplicate the process of traditional banking, we need an interest-bearing account that is self-reliant.

You acquire the whole life insurance coverage plan from the insurance business in the same way that you would any type of various other plan. Bear in mind that it will certainly require a medical examination. But also if you have some wellness concerns, do not fret. It is feasible to get a plan on someone close to you to work as your own financial institution.

Dave Ramsey Infinite Banking Concept

As you possibly recognize, insurance coverage policies have month-to-month premiums you need to cover. Since we want to make use of the whole life plan for personal financial resources, we have to treat it in a different way.

In various other words, these overfunding settlements become quickly easily accessible inside your private family financial institution. The of this additional repayment is invested in a small portion of additional permanent death benefits (called a Paid-Up Enhancement or PUA). What's remarkable is that PUAs will certainly no longer require exceptional repayments because it has actually been contractually paid up with this single settlement.

Your cash money well worth is enhanced by these Paid-Up Enhancements, which contractually start to boost at a (even if no returns were ever before paid again). The reasoning coincides as in standard financial. Financial institutions require our cash in interest-bearing accounts to obtain rich, and we need our cash in our cost savings accounts on steroids (whole life insurance policy policy) to start our personal financial method and obtain rich.

We desire to copy that. When your cash value has built up, it's time to start using it. And here is the component of this procedure that requires creative thinking.

You don't have to wait on authorization or stress over rejection.: When you take finances, none of your cash money worth ever leaves your whole life insurance coverage policy! Your complete money worth equilibrium, consisting of the amount you obtained, keeps increasing. The next action in the procedure of becoming your very own lender is to repay the plan lending.

Become Your Own Bank. Infinite Banking

Policy lendings do not show up on debt records because they are a personal contract in between you and the insurance policy firm. You set up when you pay interest and principles. You don't require to pay anything till you can make a balloon repayment for the total sum.

No various other organization gives this level of freedom to function as your own financial institution. You can plan some kind of recurring finance maintenance, but the insurance coverage agents do not require it. We did claim that this is a four-step guide, but there is one extra action that we intend to mention.

And the most effective part is that you do not have any type of restrictions on exactly how lots of times you will certainly duplicate this procedure. That's why the process of becoming your very own banker is likewise called. There are limitless opportunities for how you can utilize your own financial institution. If you still have some doubts, let's see the distinction in between your individual financial institution and a conventional one.

You have the adaptability and power to establish your own guidelines. You will certainly erase any kind of debt you might have now. You will certainly never ever have to pay interest, high costs, or charges to anybody. You will certainly develop wealth for your inheritors. Financial freedom. You can use your family financial institution for covering any expense.

Unlimited financial is the only way to really fund your way of living the means you want it. Is there anything else that you would certainly need to be your very own financial institution?

Visualize a globe where individuals have no control over their lives and are constrained to systems that leave them helpless. Image a globe without self-sovereignty the ability to take control of one's financial resources and destiny. This was our world prior to blockchain technology and cryptocurrencies. Brand-new kinds of assets like cryptocurrencies are releasing people from the limitations of traditional money and enabling them to come to be self-sovereign and independent.

Infinite Banking Scam

The principle of self-sovereignty empowers individuals to make their own decisions without undergoing the control of effective central authorities. This idea has actually been around for fairly a long time. Self-sovereignty implies that every individual has the power and flexibility to make their very own decisions without being controlled by others.

When you place your cash in a financial institution, you partly shed control of it. It ends up being the bank's money to do as they see fit, and just a section is guaranteed.

These wallets offer you single access to your funds, which are safeguarded by a personal key just you can control. Non-custodial cold pocketbooks are much safer as there is no central database for cyberpunks to get into and steal your personal secret. You can also access your money anytime, despite what takes place to the firm that made the pocketbook.

If it goes bankrupt, you may shed your coins with little hope of obtaining them back. However, if you utilize a non-custodial pocketbook and maintain your exclusive key risk-free, this can't occur. Your cash is saved on the blockchain, and you save the personal keys. Discover more concerning why you shouldn't keep your assets on exchanges.

Start Your Own Personal Bank

If you keep it in a non-custodial pocketbook, there is no threat of a financial institution run or a hacking attack. There is much less possibility of any individual compeling the budget owner to do anything they do not desire to do.

Latest Posts

Infinite Banking Canada

Life Insurance Banking

Whole Life Insurance For Infinite Banking